Christmas, Reservoirs, and 2nd Rate Hike in a Decade

Submitted by DeDora Capital on December 16th, 2016

by Will Becker, AWMA/AIF

Happy Friday!

Christmas is upon us - may your travels be safe and celebrations bountiful. Merry Christmas & Happy Holidays from all of us at DeDora Capital!

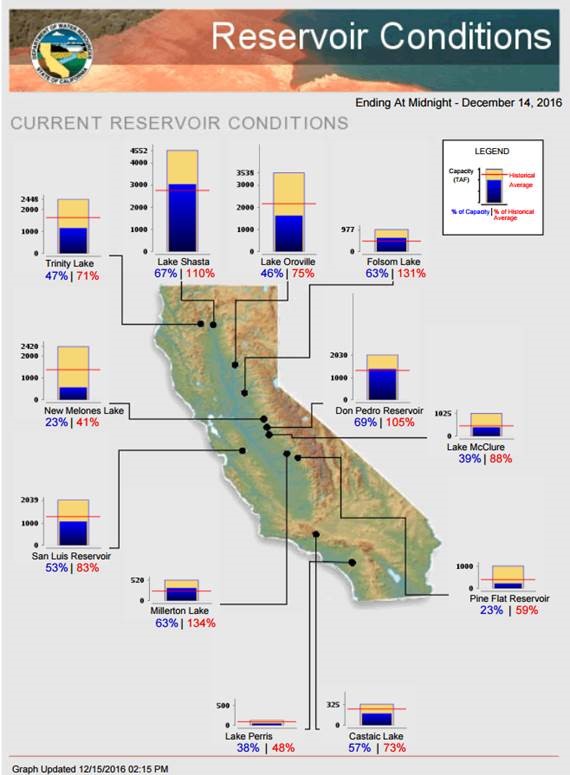

As I am writing, it is POURING RAIN here in Napa and there is a Flash Flood warning. During this time last year, ZERO of the major California Reservoirs were at their Historical Average levels. Today, things look a bit better with Shasta, Folsom, Don Pedro, and Millerton above their Historical Averages according to the Ca Dept of Water Resources.

Investment Perspective

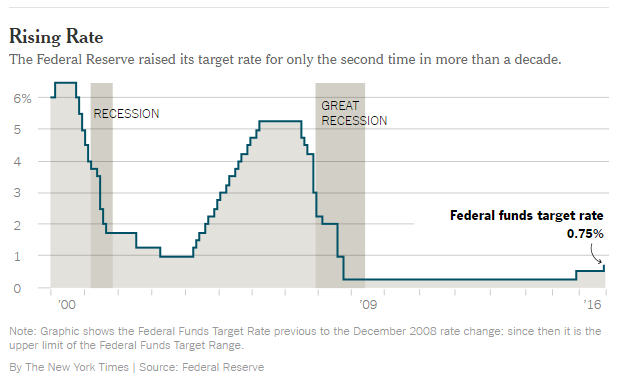

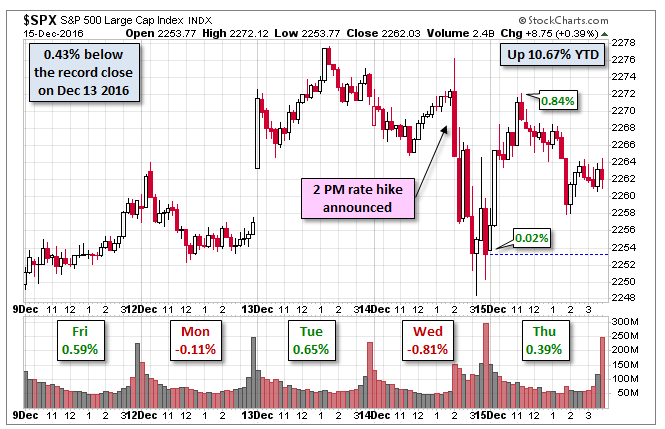

This week the Federal Reserve raised interest rates for the second time in a decade. Markets went Up! Markets went Down! Markets woke up the next day and went Up! What was this all about? Federal Reserve Chair Janet Yellen reported economic strength, and anticipates three additional rate hikes in 2017. In particular, she said that the Federal Reserve is “recognizing the considerable progress the economy has made.” Below is a chart showing how long the rates were low.

We will do a more thorough review of 2016 in January once the final numbers are in, but first a quick refresher that this year started of terribly in the markets; it was the worst 10 day start in history. Yet, today as we close in on the final trading days of the year, the S&P 500 is currently +10%... and that is without Quantitative easing, after a mild “earnings recession”, Brexit, slowing Chinese growth, Zika, a highly unusual US Election, North Korea testing a Nuclear bomb, losing Prince, David Bowie, and Muhammed Ali… and more! We track the news, but I have to say that so much of what we do is filter what is true economic news out of the cacophony of endless noise. I hope that these updates help in that effort!

The big question, of course, is how the 2016 Election will impact the markets in 2017. Contrary to so many pundits expectations, the US Markets have shot higher with President-Elect Trump. In many ways, it seems like the markets are pricing in a “Goldilocks Scenario” whereby just the right combination of tax & regulatory changes coincide with a strong phase of the business cycle… and result in dramatic growth. We are optimistic about 2017, actually, but it seems like some of 2017’s thunder is getting stolen by December 2016.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.