Charting Like It's 1786 & World Median Ages

Submitted by DeDora Capital on April 7th, 2016

by Will Becker, AWMA/AIF

I have a few comments on charts, then close out with some economic thoughts. There is a common saying among investors that “this time is different.” It feels so good to discover a new and better way of looking at things; and humbling to find that someone else already figured it out years ago. This is why I like studying history. It turns out that sometimes not so much is actually different. On that note, one book I have been reading recently is “100 Diagrams that Changed the World”. If you haven’t picked up on this already, I really like charts and graphics. Maybe it was the formative experience of reading National Geographic magazines when I was growing up. But when I see a bunch of data I usually try to turn it into an image in order to understand the story it has to tell. If done well, it changes my way of thinking - at least a little bit.

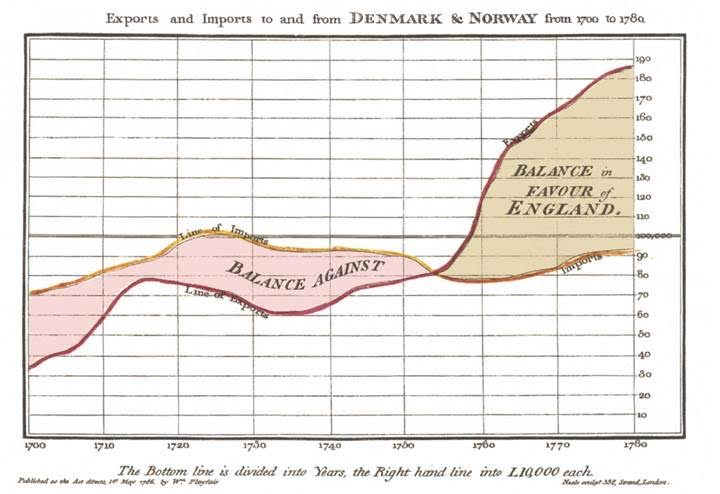

Here is an example from the 100 Diagrams book. Back in 1786 a guy by the name of William Playfair tried to make sense of Export and Import between England and Denmark/Norway. He created an entirely new way of looking at the data - what a beautiful chart he created! England’s exports really started doing well around 1755, apparently. All of this comes to mind because there is a kind of chart that we use today that is very similar to Mr. Playfair’s chart. It’s called a “Moving Average Convergence Divergence” chart, but maybe we should give credit where it is due and call it a Playfair.

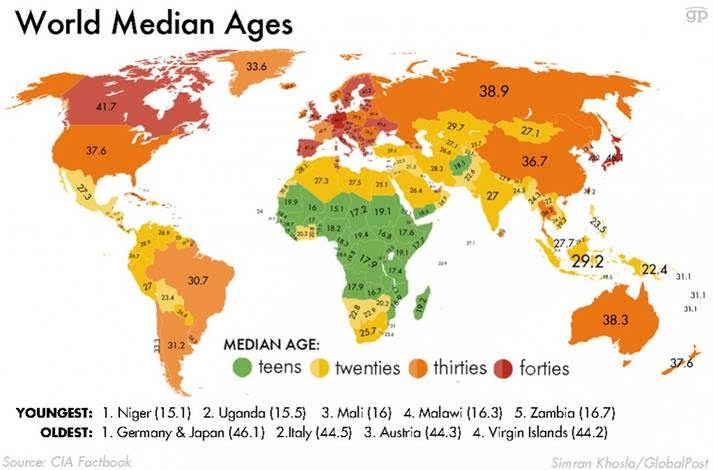

Speaking of charts, here is a modern chart that landed in my inbox this week and, frankly, shocked me. I had seen some data about median ages per country before, but note how many countries (in green) have median ages HALF of the US’s. I’m feeling old now. This is one reason that in the last decade I have been active with a nonprofit based in Kenya that is training young leaders. In a region with a median age around 17 years old, mentorship and leadership development is integral for the next generation of managers and executives.

To close out, here are some economic thoughts. My own economic view is turning less optimistic. Today we have a new set of economic cross-winds that increase likelihood of unpredictable things happening in the markets.

- On the dour side: the election year impact on the markets is not entirely clear yet; to put it another way, not all of the candidates are priced into the market. Earnings growth overall is under pressure; it’s possible that it’s not all oil’s fault. Companies buying back their own stock accounts for a shockingly large amount of market buying this year; that can change. Add in the Federal Reserve’s interest rate policy and questions about the potential economic impact of the Zika virus, and we have increased uncertainty. Markets don’t like uncertainty.

- One the bright(er) side: the strong dollar is hurting exports; if the dollar weakens, earnings should go up. The US economy looks comparatively stable from a global perspective. Apparently there is enough cash in people’s accounts to buy $14 Billion worth of Tesla Model 3’s – an electric car that won’t be delivered for a year. As investment blogger Josh Brown so eloquently said:

“we have miniature computers more powerful than rocketships in our pockets, cars that are beginning to drive themselves and technological advances that remove millions of people out of lives of hard labor and into air conditioned offices with bean bag chairs and all the k-cup coffee we can drink. Stocks are near record highs, the labor market is growing tighter, wages are being pushed up and profits across many sectors of the economy remain elevated for years on end.”

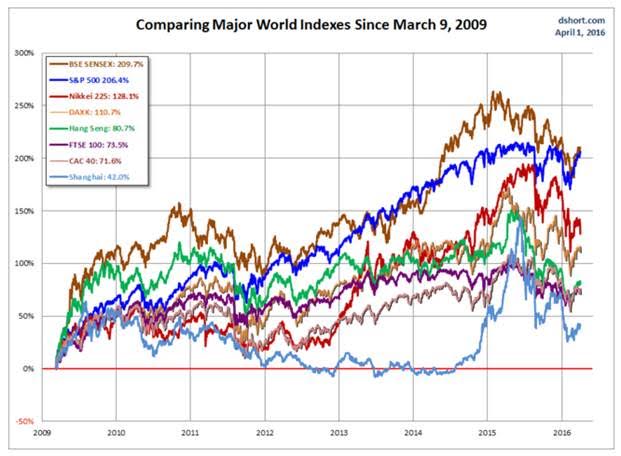

- If all of this sounds decidedly conflicted, that’s because it is the kind of mixed messages common in the later stages of a business cycle. Remember that the S&P is up over +200% since 2009. We have experienced a degree of mostly-uninterrupted market expansion that is more consistent than the rest of the world (see the Blue line on the chart below). But we don’t take for granted that it will go on that way indefinitely. Things may get rocky if the cross-winds turn into head-winds.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.