Charlottsville and Trends

Submitted by DeDora Capital on August 25th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

First, a note about the recent violence in Charlottsville. As a firm, we are fiercely non partisan. Our philosophy and mission is as folllows: "We believe in the power of running successful businesses, spending time with family, enjoying retirement, and making a responsible impact in our community. Our mission is to make a meaningful difference in the financial lives of our clients and community every day. We fulfill our mission through comprehensive wealth planning to guide financial decisions and investing assets to build client wealth." With that in mind, we feel compelled to make clear that we believe in treating people with respect, welcoming a variety of perspectives, and abiding by the rule of law. Violence, hate, fascism, and division have no place in our firm.

This month, companies such as General Motors, Aetna, JP Morgan, Merck, Johnson & Johnson, Intel, Walmart, Campbell Soup, IBM, Starbucks, stepped down from President Trump's Advisory Councils. Some companies stayed on before the Councils were disbanded. But it is worth noting that the companies that elected to step down represent over 25% of the Dow Jones Industrial Average. Many of the companies that stepped down cited moral inconsistency between President Trumps response to the events at Charlottsville and the companies' core values. Intel's statement, though, took a pragmatic long view:

"We have worked with every U.S. president since Woodrow Wilson. We are determinedly nonpartisan — we maintain no political action committee. And we have always believed that dialogue is critical to progress; that is why I joined the President’s Forum earlier this year. But this group can no longer serve the purpose for which it was formed. Earlier today I spoke with other members of the forum and we agreed to disband the group."

As Planners and Investors, how do these events affect us? It can feel like violence and tensions are on the rise. Is this closer to a long term rise, or modest increase in the midst of a long term decrease?

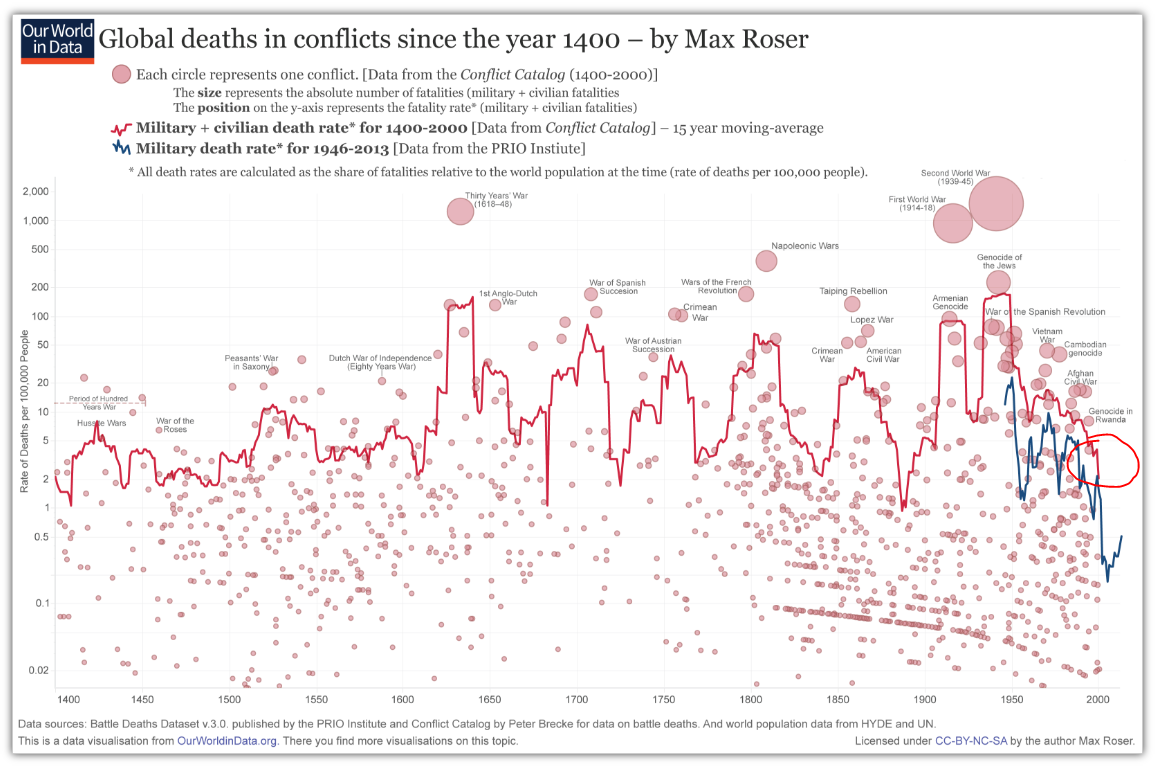

It turns out that researchers have tracked levels of violence in a variety of ways, and the results of the data is that violence is on the decline. Dr. Steven Pinker from Harvard goes so far as to say that "violence has been in decline over long stretches of time, and we may be living in the most peaceful time in our species' existence." How can he make such a bold statement? Globally, deaths due to wars are at historically low levels (Current level in Red circle on the right).

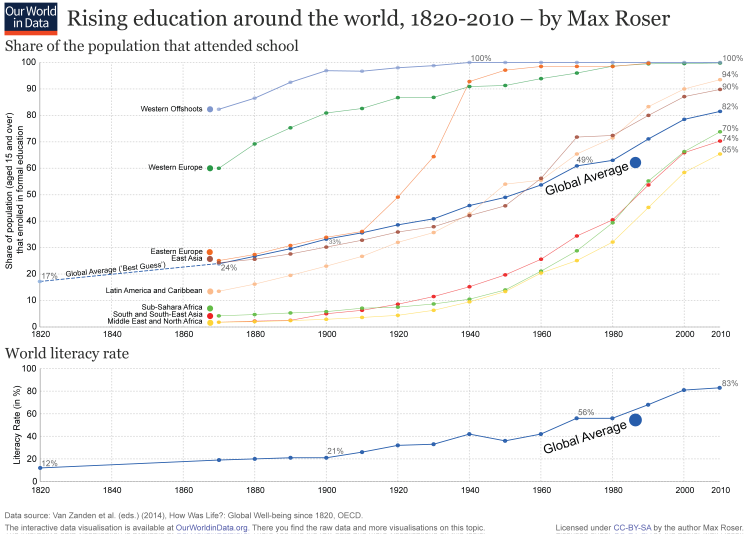

Why is violence on the decline, and what is increasing instead? It turns out that global literacy more than doubled in the past 50 years (chart below).

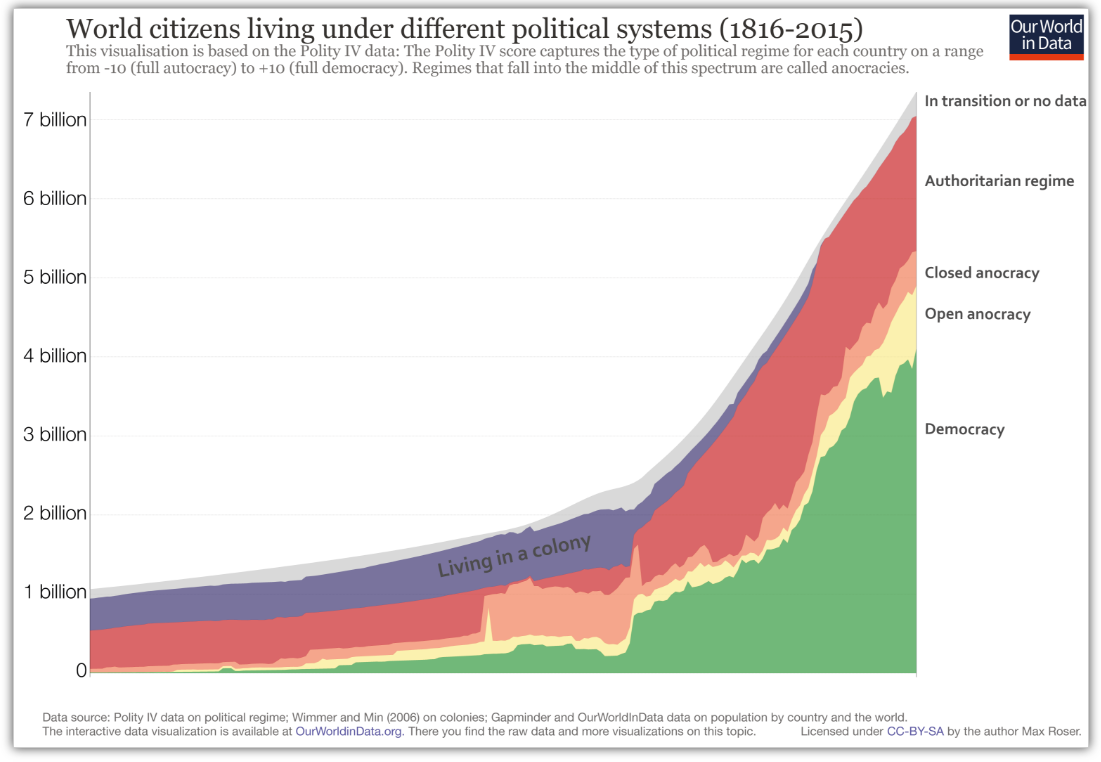

Not withstanding headlines about Syria, North Korea, and other authoritarian regimes, Democracy is consistently on the rise. Authoritarian regimes are stubbornly holding on, but there is really only one category in the chart below that is growing rapidly, and that is Democracy.

Similarly, International Trade continues to grow dramatically.

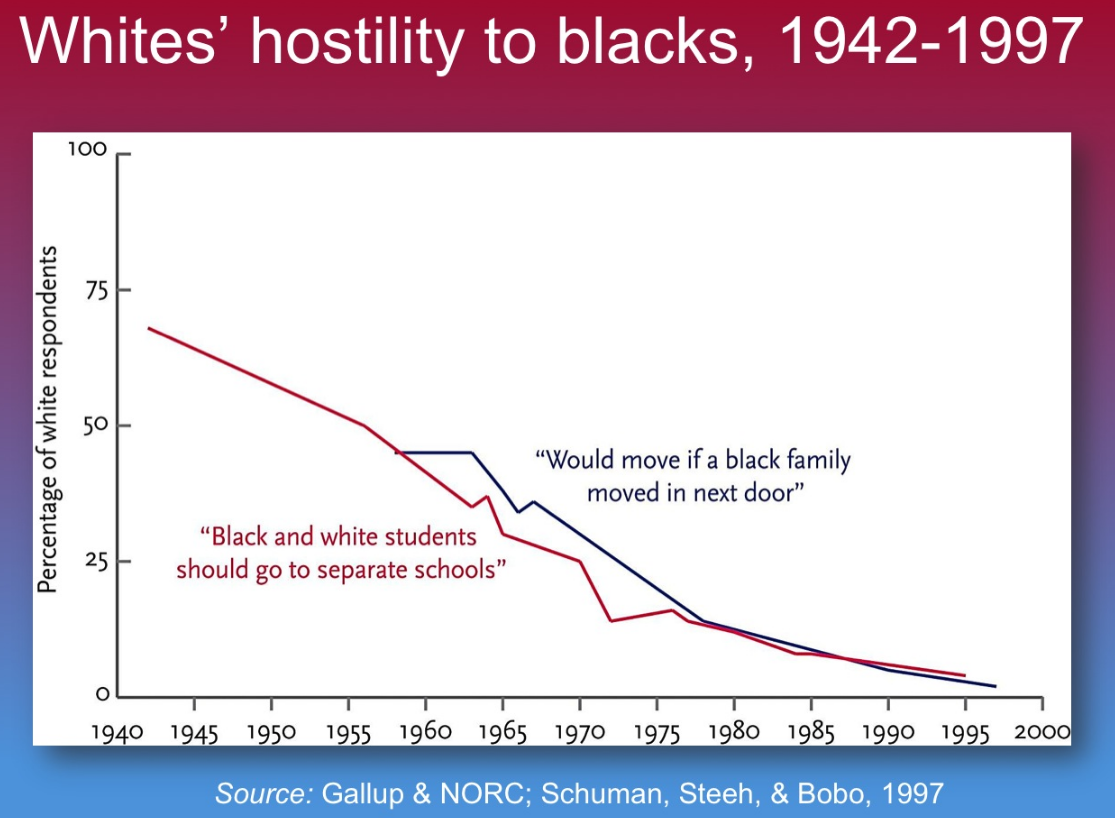

So if the world is more literate, democratic, and engaged in more commerce than ever before... then what about the USA? Focusing in on the USA in the past century, this is borne out in our own racial relations. One example: Fifty years ago, half of white Americans said that "black and white students should go to separate schools", and nearly the same number said they "would move if a black family moved in next door." By the end of the 21st century, by far the dominant view was the opposite; White responses to those same questions were in single-digits.

Why go into this in such detail on social issues? As Planners and Investors, we have to keep our eyes open to political events that spill into economic events; and this means discerning where the Trend is. Trend is part of our investing lingo. An uptrend shows price increase over time, while a downtrend shows price decrease. However even strong trends can have short periods when they seem like they are going backwards. These are counter-trends. Below is a chart from blogger Josh Brown, showing counter-trends in the decline of the 10 Year Treasury Yield. Josh's point is that we are currently witnessing a modest social counter-trend.

Will this counter-trend of social and racial tensions continue to rise? Will it break out and be a "new normal"? Will it undermine economic health? These are things we have to keep an eye on. In the meantime, let's treat eachother with respect, be open to other people's perspectives, and continue this nation's great tradition of valuing the unalienable rights of life, liberty, and the pursuit of happiness.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.