Care vs Reckless

Submitted by DeDora Capital on December 1st, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Planning Perspective

This week Paul and I took some time out of the office for our annual off-site Planning Meeting. Each November we take a full 1-2 days to celebrate successes, learn from frustrations, and set areas to focus on for the next year. At the risk of sounding like a broken record, we are full of gratitude for the privilege of working with our clients. Our mission is to make a meaningful difference in our clients lives, every day. Working with clients brings our mission to life.

As we reviewed the kinds of situations that we worked with over the year, we realized that there is one key concept that we keep coming back to: Care vs Reckless. Google (below) reminds us that Reckless is "without thinking or caring about the consequences of an action," while Care (below) is "consideration applied to doing something correctly or to avoid damage or risk." We DO CARE about the consequences for our clients. We are incredulous that it could be any other way! In fact, much of what we do is provide clarity on what the consequences - good or bad! - of a decision will most likely be. For example: Will working over the holidays fund an annual trip? Good consequence! Will selling the rental house cost much more in taxes than anticipated and not actually fund the desired goal? Bad consequence! Does working one more year mean a nice big step up in pension income for the rest of the client's life? Good consequence!

In many ways, financial planning is the science and art of lining up good consequences so that they support the client's goals; the goals are reasonably funded, the investments' expected returns are consistent with the plan, there is as much tax efficiency involved as reasonably possible, the catastrophic risks are discussed and addressed, and the Financial/Tax/Estate plans are aligned. As we re-read the dictionary definition of Care, we were reminded that what we do can be so elegantly summarized in one simple idea: We Care. We give attention and consideration to helping solve the most pressing financial dilemmas that our clients face. We care what happens to our clients, we care about the decisions our clients face, and we care about what is important to our clients. We try to avoid financial damage, we take educated risks. "Care" is one of those words that I've used all my life and really only came to appreciate after seeing what happens when it is not present.

From Googling the definitions of reckless and care:

Investment Perspective

On Thursday, the Dow Jones and S&P 500 hit all-time highs as Wall Street viewed the pending Tax Bill as a pretty much sure-thing. After all, Senator John McCain supports it... and after the Health Care reform fell apart when he opposed it, that's kind of a big deal. Hence the headline saying Dow rips 331 points higher, closes above 24,000 as chances of Senate tax bill passing rise. The bar for Congress is so low that one analyst said that passing a Tax Bill is "a psychological factor that Congress can get something done." This, of course, is after a congressional analysis that "the Senate tax plan would add more than $1 trillion to federal deficits over a decade even after economic growth is taken into account." So, then they added a "Fiscal Trigger" to raise taxes if growth comes in slower than projected. But then... oops... the Senate parliamentarian said they couldn't use the "Fiscal Trigger". So as of this writing (Thursday eve), the Senate has delayed the tax bill vote as setback hits in final hours. This may be a rocky ride while Congress figures out how to pass it. This session of Congress has 89 enacted Bills, so they know how to pass a decent bill, right?

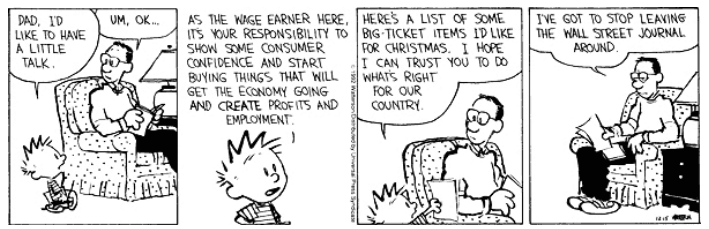

Lastly, I am still in denial that Christmas is THIS MONTH. With that in mind, here are some words of wisdom from Calvin & Hobbes.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.