Brexit/Bregret

Submitted by DeDora Capital on June 30th, 2016

by Will Becker, AWMA/AIF

Happy 4th of July Weekend!

It’s hot and dry, so please don’t start any fires this weekend with those 4th of July fireworks!

Investment Perspective

Last week, the United Kingdom voted to become less united with the broader European Union. The British Exit - or Brexit - from the European Union came as a surprise to the pollsters, pundits, and major financial markets. In this update I’m going to review what the Brexit is, what appears to have transpired, and what it means for investors.

In fact, Britain’s dis-engagement with the European Union came as a surprise to much of the world. Notably, one of the few people not surprised by the vote was a guy named Mike Carter that recently walked from Liverpool to London. After speaking with people along the way, he found that support for leaving the European Union was surprisingly consistent. Perhaps this is a reminder that listening to what everyday people have to say is a pretty good poll?

Now a little perspective on the economic size of the United Kingdom and the European Union. When the member states of the European Union are combined, they very nearly equal the economic size of the United States (see Gross Domestic Product charts from Wikipedia below). But with 24 official languages, 28 sovereign nations, and a burgeoning bureaucracy, the European Union has also fostered a lot of frustration. While proponents of the European Union can rightfully claim a win due to the fact that we haven’t had a World War in over 50 years, detractors point to a myriad of waste and odd regulations. Regulations concerning the curvature of bananas is one noteworthy example. Turning now to the United Kingdom, they have a Gross Domestic Product of about $2.8 Trillion in US Dollars. By comparison, that is about the economic size of California and Oregon combined. So while the United Kingdom is the fifth largest economy in the world, it is much smaller than the United States and noticeably smaller than China, Japan, and Germany.

Nations in the European Union (from Wikipedia):

Now how about a quick recap of what transpired since the United Kingdom voted last week on Thursday:

- 52% of the UK vote to leave the European Union.

- 62% of Scots, however, vote to stay in the European Union.

- Many Brits “frantically Googling what the E.U. is, hours after voting to leave it” and there’s now a thing called “Bremorsers” and “Bregret”, or British people that regret their vote to leave the European Union.

- The UK’s Prime Minister David Cameron resigns.

- European Union member states call for the UK to make a hasty exit.

- Standard & Poors downgrades UK credit rating.

- Britons flood Ireland with EU passport applications.

- Scotland makes rumblings about either blocking the Brexit, going for its own independence, or joining the European Union separately.

- Gibraltar, Scotland, and Northern Ireland open talks to keep their European Union membership active while England departs.

- It turns out the vote is just “advisory” – not legally binding. The UK might not leave the European Union after all.

- While English is the dominating language of the European Union, it may be removed as one of the 24 official languages if the UK leaves. Each member country gets to choose an official language, and for an indication of just how not-unified the British Isles are, Ireland chose Gaelic/Irish.

- Evidently Brexit is bad for British cheese.

Now a few comments. Britain might not leave the European Union after all. The Parliament might refuse, the Scots might veto, the UK might take a do-over vote. But could this be the beginning of the end of the European Union - is this the beginning of other countries leaving the European Union? Our primary concern has been whether Brexit is a harbinger of things to come, like the fall of Lehman Brothers during the onset of the Great Recession. However, there is ample evidence that this is not a fiscal crisis.

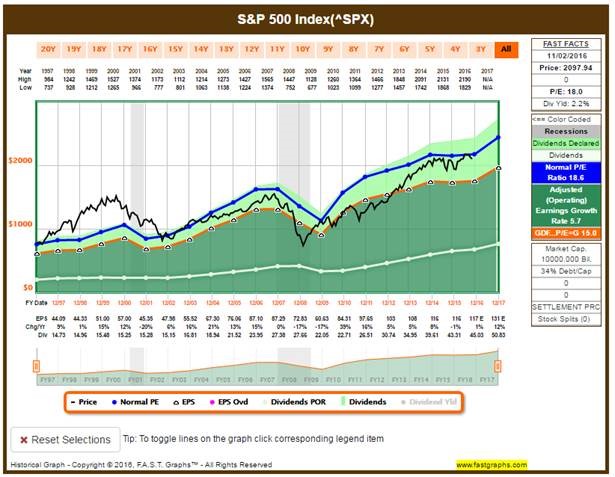

What is the investment impact? U.S. Equity markets had rallied leading up to the Brexit vote… assuming that surely the UK would remain in the European Union. Then the Brexit results came in and there was a two-day selloff, and on Tuesday the markets realized that the sky hasn’t fallen and this will take a long time to sort out and it’s far from a sure thing anyway. So at this point the S&P 500 is +1.31% for the year, and is back to where it was last week. And if the one outcome of this update is that the market is where it was at a week ago and we were studiously monitoring the drama, then I’m going to call that a win! Brexit could turn out to be a regional economic drama, it could turn out to bring the next recession sooner than it otherwise would, it could also turn out to not happen.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.