Brexit, Time, and Health

Submitted by DeDora Capital on April 4th, 2019by Will Becker, AWMA/AIF

Happy Friday!

Time & Health

The April 15th Tax deadline is right around the corner. If you need any account information for taxes, or will be making an IRA Contribution, just let us know!

Last week I had the pleasure of speaking with a group of staff at the local Boys & Girls Club on Financial Topics. They are mostly “Generation Z”, born after the mid 1990’s. A topic came up that was definitely true for them, but also in one way or another, true for each of us. Each day we are blessed with some amount of two powerful assets: time & health. Too often, we do not recognize or appreciate time & health until it is too late. This often comes up in retirement planning conversations when we talk about traveling while the body is able. Those in their first two decades of life are wealthy in time, and hopefully in health; let’s not take either for granted, no matter where we are in life!

Global Slowdown vs Strong Manufacturing

Economic Indicators continue to be “ok, but weakening”, while the Stock Markets punch new highs for the year… so what gives?

Trade is a big factor. The US Stock Markets weren’t the only ones going up on trade talks. Reuters reports that “China stocks ended at an over one-year high on Thursday, with the blue-chip index rising for a fourth straight week as investors cheered progress in trade talks.” Manufacturing in both the US and China are up. The first chart below shows the S&P 500 reaching its Year to Date high, returning to the high from January of 2018 and nearing the highs of September/October 2018.

At this point, the US economy is in a situation where the Federal Reserve is being friendly with low interest rates, China is adding stimulus in their economy, and there is a possible trade deal between the US and China that could boost economic activity. Could that be enough to revive the slowing global growth?

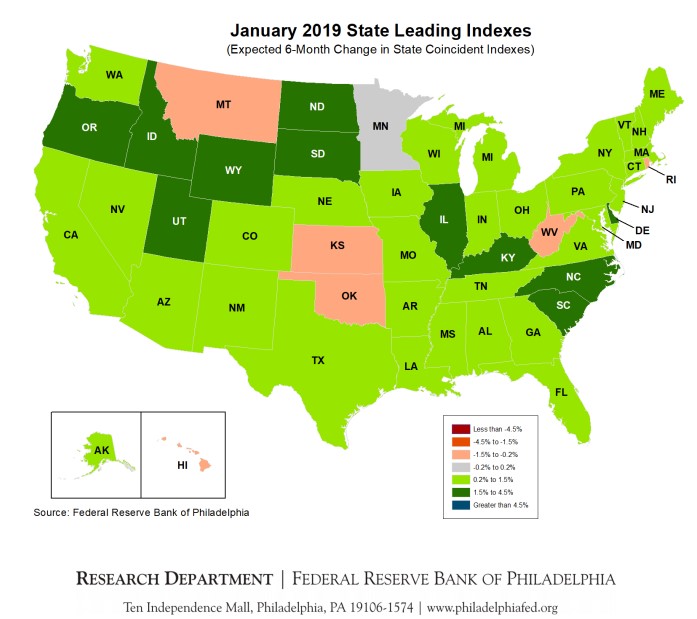

As of the most recent data in January, the Philadelphia Federal Reserve is showing positive state-level leading indicators among all but five states (see second chart below).

Brexit

In my youth during the 1980 and 1990’s, Northern Ireland was predominantly in the news due to the longstanding violence, or “The Troubles.” Fast forward to 2019, and Northern Ireland is in the news due to very much NOT wanting checkpoints on the border with Ireland. You would think that having a land border with the European Union isn’t an issue for the definitely-is-an-island United Kingdom. But Ireland is in the Eurozone, while Northern Ireland is part of the United Kingdom. So that pesky Ireland/Northern Ireland border is back in the economic and political arena.

You can pick the problem that Brexit supporters said they were solving – some say job loss, others immigration, etc – but at this point, Brexit is aWicked Problem. Wicked problems are “difficult or impossible to solve because of incomplete, contradictory, and changing requirements that are often difficult to recognize.” These are problems that are resistant to a solution. For example, putting checkpoints at the Ireland/Northern Ireland border could solve the Brexit issue… but might violate the Good Friday agreement that ended The Troubles. That’s a Wicked problem.

While the gears of political decision making slowly grind, businesses are preparing… and it’s not looking good for the UK.

Speaking of businesses in Britain, a surprising number of very British brands are owned by foreign companies. Here are four that stand out, and an article about 29 more.

- Jaguar & Land Rover – owned by Ford, then India’s Tata motors since 2008.

- Rolls Royce – owned by German car company BMW.

- Manchester United – owned by a family in the US.

- Double Decker London Busses – operated by the Deutsche Bahn German national railway.

Here's to everyone that's been THAT friend (especially at 1:40 into the video).

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.