Brexit and a Global Dearth of Yield

Submitted by DeDora Capital on July 14th, 2016

by Will Becker, AWMA/AIF

Investment Perspective

Last month Britain voted to leave the European Union, and a casual scan of the financial news made it seem like economic Armageddon was upon us. But this week the markets are punching all-time highs. Wait, what? But wasn’t life as we knew it supposed to end as markets fell into an unrecoverable downward spiral? Last February I wrote that:

“humans are notoriously bad investors. According to Dalbar, for the past 20 years the average Stock Fund investor earned 5.2% annually while the S&P 500 earned 9.85%. Our natural instincts to dive for cover when the Mastadon charge us is pretty good for surviving on the open range, but it turns out it doesn’t work so well with investing. Unfortunately, people are all-too-tempted to sell when the going is rough and buy after the growth happened.”

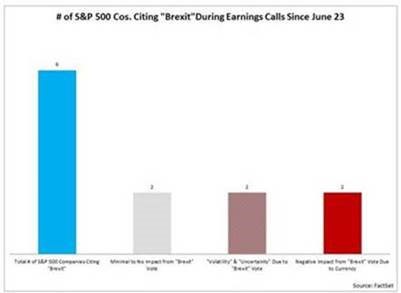

So with that in mind, here’s an update on economic items from the past couple weeks. First, companies are still sorting out what a Brexit might mean, as these stats from Earnings calls reveal. But Brexit is by no means a sure thing, the impact is mixed, and there are even some possible benefits for the US economy.

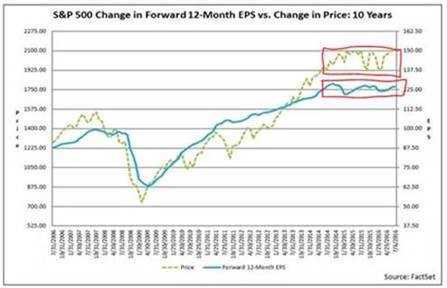

Meanwhile, Inflation & Economic activity ticked up while Unemployment ticked down. Good news! Not everything is smooth, though. Earnings are mixed, and it’s an open question whether the S&P will pull out Earnings growth this year. Earnings have basically been flat for about a year. The S&P has toggled back and forth in a pretty narrow range during that time, as displayed in the chart below with my edits in Red.

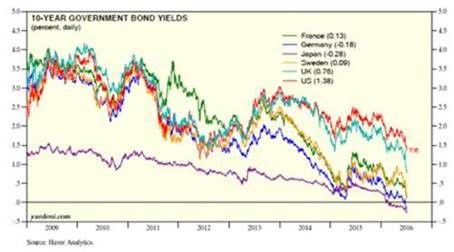

Internationally, Central banks are still trying to pump liquidity into global markets. This is resulting in a long, steady decline in Global Bond yields. Below is a chart illustrating the decline in yields – including two with negative rates - and a noteworthy comic on the topic of negative interest rates…

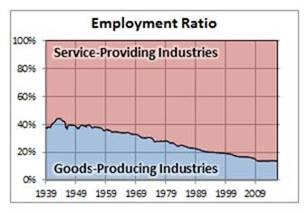

In the longer term, the U.S. economy continues to transition away from Goods-Producing jobs. The rate of Goods-Producing jobs in the U.S. is less than half of what it was a century ago. A generation of Americans grew up pretty confident that they could get a factory job (Goods-Producing!) out of school. My generation was more of the work-at-Starbucks (Service-Producing!)-until-landing-the-desired-job kind of situation. That illustrates the transition from roughly 40% Goods-Producing to roughly 80% Service-Producing in 60 years. Incidentally, China is trying very hard to make a similar transition from Manufacturing to Service-Producing.

I’ll close out with a few additions to the “things ain’t what they used to be” topic. This year – and even in the past couple weeks – there have been a few news stories that remind me that the times they are a changin’. Here is a quick roundup:

- Self-Driving cars get in trouble: two Tesla’s crashed while on Autopilot. I’m not actually debating about whether the self-driving cars are safer or not, but instead I want to point out that there are cars driving themselves on the roads. This is kind of a big deal! Plus the major auto manufacturers are investing heavily in self-driving technology… so we should expect to see more of this.

- Amazon invented their own shopping holiday – “Prime Day” – and in year two they pulled in about $525 million in sales. For reference, that is more than the Annual Gross Domestic Product of a small country such as Tonga.

- A week after launch, the smartphone app called “Pokemon Go” has 21 million players and is kind of like Geo-Caching that bridges the gap between the gaming world and the real life world. But sometimes with tragic consequences. Here’s an article describing what it is, in case you are curious. I’m not particularly curious about it, for the record, but when 21 million people are doing something I pay attention!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.