Being Utterly Unreasonable & 6 Core Fiduciary Duties

Submitted by DeDora Capital on March 24th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Fiduciary Update

Back on 9/23/2016, I said that "There is something that Paul, Forrest, Terri, Janie, and I are utterly unreasonable about: upholding our legal and ethical duty to act in the best interest of our clients. That’s what it means to be a Fiduciary for our clients."

So we were really happy that the Department of Labor was on track for the April 10th 2017 rollout of the Fiduciary Rule that would require all Financial Advisors and stockbrokers to adhere to the Fiduciary Standard in retirement accounts. Yay! Finally! Consumers deserve recommendations based on their best interests! We thought it should have been even stronger (how about ALL investment accounts!), but at least it was a step in the right direction.

But then on February 3rd 2017, President Trump ordered the Department of Labor to re-analyze the Rule and at this point it is delayed and on life support. The rule was just two months from taking effect and protecting consumers! But now it is legal for brokers to continue to give bad advice so they can make bigger commissions. To say that we are disappointed is an understatement. We think that ALL investors deserve to have their best interests first. We think that ALL investors deserve advice that is clear, concise, without commissions, and with the fewest conflicts of interest possible. Don't just take my word for it, though. Ron Rhoades is an Attorney, Professor, Financial Advisor, and Author... so we pay attention to what he says. In this case, what he says is not at all subtle:

"a delay is going to essentially transfer tens of billions of dollars a year from the retirement savings of tens of millions of Americans to Wall Street and insurance companies. In their IRA accounts and 401ks accounts, the vast majority of consumers are still going to receive conflicted advice."

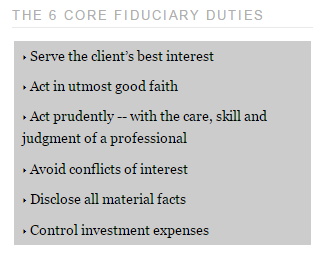

So now that the "DOL Fiduciary Rule" may be history, what do we do? We doubled down on Fiduciary status by earning a Firm-wide Fiduciary designation from the Institute for the Fiduciary Standard. As individual professionals we were already Fiduciaries - I have the Accredited Investment Fiduciary (AIF) designation, and Paul and Forrest are Fiduciaries through their Certified Financial Planner (CFP) designations. But at a time when putting clients' best interests comes under fire, we are compelled to double down on doing what's right at the Firm level. We really, truly, wish that every Financial Advisor and Stock Broker came over to the Fiduciary side. It is a zen-like beauty to know that we have one revenue source - our clients - and that each recommendation has one consideration - our client's best interest. Until that is the rule across the land, we will continue to educate folks and encourage people to get advice from those that put their best interests first.

Ok, I'm off the soapbox now.

Investment Perspective

The markets have priced in the assumption that President Trump's Tax reforms take effect. President Trump said that he will address Health Care reform, then go on to Tax reforms. At the moment, the Health Care reforms are looking pretty iffy and may lead to delays in tax reform. As of Thursday when I am writing this, NBC is reporting that Budget Director Mick Mulvaney said that "if Trump does not get a vote on the proposal, he will move on to other priorities and leave the ACA, also known as Obamacare, in place." This could have to do with a potentially damaging domino effect of delays, as well as the long road ahead for a contentious bill even if it passes the House of Representatives. For example, delays in the Health Care reforms could cause delays in Tax reform, causing delays in infrastructure spending... all of which the markets have priced in. The reason that I am going in to some detail on this is for the simple reason that delays in the Tax or infrastructure spending changes will likely cause markets to be unhappy. Heads up there. And for the record, I'm not saying that the reforms are a good idea or bad idea - we are investors, not politicians!

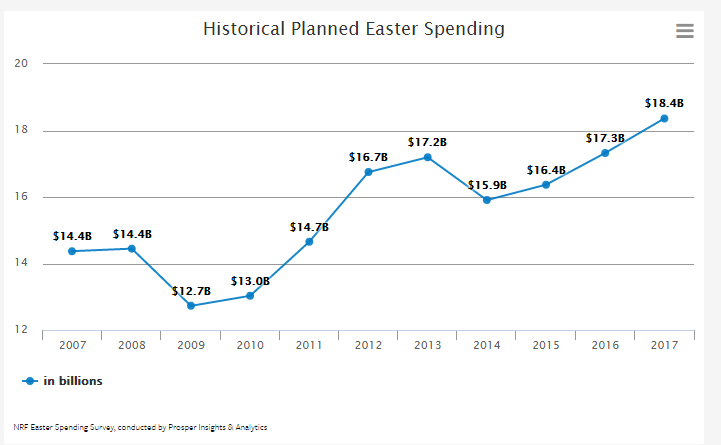

Now, on a lighter note, Easter will soon be upon us! For the first time, Americans will spend $18 Billion on Easter. The National Retail Federation says that "with the economy improving, consumers are ready to shop and retailers are ready to offer great deals whether they’re buying Easter baskets or garden tools."

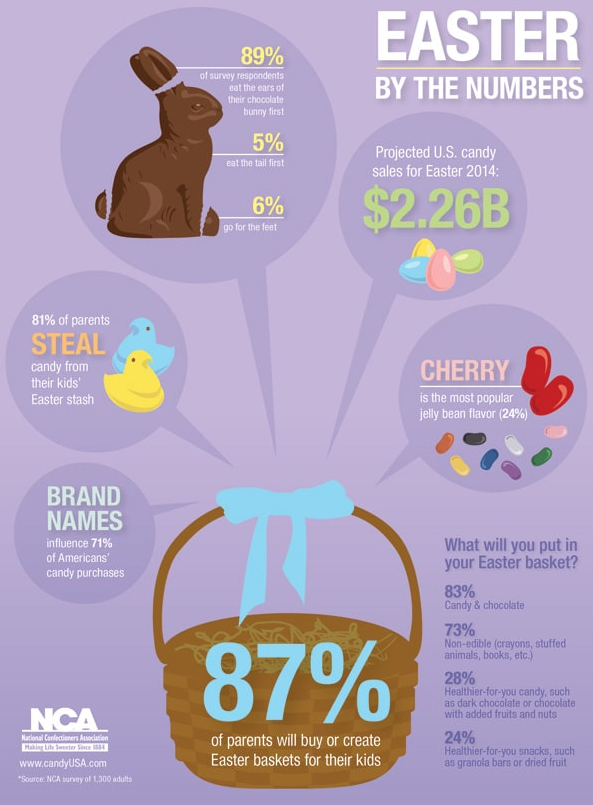

While their data is a few years old, I have to wonder why there are only 6% of us that eat the Chocolate Easter Bunny Feet first. I don't know about that data!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.