Beardstown Ladies & Maserati

Submitted by DeDora Capital on October 22nd, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

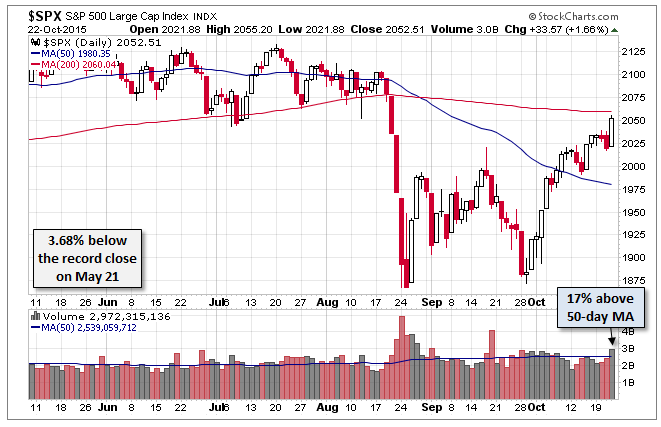

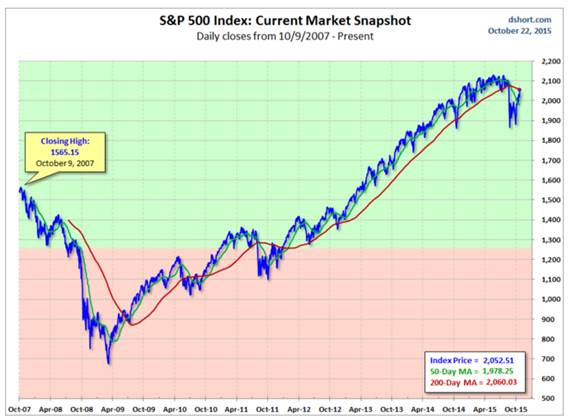

A quick note on the markets, and then the Beardstown Ladies, parking lots, and Ferrari. The S&P 500 came zooming back this week, primarily the result of strong earnings reports and the European Central Bank making comments about adding stimulus to the European economies. As of Thursday when I am writing this, the S&P 500 is above the 50 Day moving average and is within striking distance of the 200 Day moving average. Below are two charts showing the S&P 500’s performance. The August 18-24 correction was rough, not going to lie. But this is why we do such deep economic analysis; the markets needed to hit the pressure relief valve, the underlying fundamentals were actually ok, it was time to be careful on the way down and invested for the rebound.

Now on to another subject. One of the first investment books I read was by the “Beardstown Ladies,” an investing club in Illinois. I was cleaning up the bookshelf recently found the dusty old book that I first read about 25 years ago. The Beardstown Ladies later got in some controversy over how their investment returns were verified (or not!), but no matter how you look at it, they had strong investment returns for many, many years. I was about 12 years old when I first read their book, and the plain-english way they described economics made a lasting impression on me. Aside from nostalgia, why am I mentioning this? The Beardstown Ladies pointed out that economics are happening all around us. Constantly. In fact, store parking lots are a great way to identify 1) how the store is doing, and 2) what kinds of cars people are buying. Both of those are barometers for what’s happening in the economy overall. I know this sounds like common sense, but I dare say that using our eyes to actually observe what’s happening around us is a good compliment to reviewing financials, fundamental & technical indicators, and everything else that we do.

With that in mind, here is an observation. I routinely run errands near the Bel Aire Plaza on Trancas Street in Napa, where the Whole Foods, Trader Joe’s, and Orchard Supply are located. Plus my daughter’s favorite desert location: Yobelle Frozen Yogurt. What does that grocery store parking lot say about current economics? Back in 2008, it seemed like there were suddenly a LOT of Priuses (or Prii) silently driving around, a few years later the Porsche Cayenne’s starting taking more parking lot territory, Teslas made their mark, and then in 2014 a surprising number of Maserati’s were purring their way around. There was a noticeable spike in Mini Coopers in there, too. It was kind of like when Subaru’s invaded Tahoe in the 1990’s. If you are shaking your head, wondering what luxury car planet I am talking about… I admit that Napa may have its own economic weather system. For the record, I drive a Subaru.

As investors, Paul and I look for what the current economic behaviors tell us about the future. Perhaps a harbinger of parking lot trends to come, this week Ferrari’s Initial Public Offering (IPO) hit the markets. Last year Ferrari’s President Luc Cordero di Montezemolo resigned, partly because he refused to make more than 7,000 cars per year. Montezemolo wanted to keep Ferrari small & exclusive, while the CEO wanted to ramp up production. So the guy that wanted to expand won. That same year Maserati – another Fiat brand – doubled its production for the second straight year.

As a refresher, here are the primary Fiat-Chrysler :

What does all of this mean?

- Luxury car sales are booming in the North Bay.

- Ferrari is jumping on the rapid-expansion bandwagon, so we should expect to see a lot more Ferrari’s driving around.

- When the economy weakens… very likely that the luxury brands will be hit early on.

- Ferrari is one of the most iconic brands of all time. It is a fascinating story, but not necessarily a great investment. We have it under review for aggressive growth portfolios, but it’s going to have to earn its way in.

- I want a Ferrari. Did I just say that out loud? But, alas, it is not in my Financial Plan.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.