Be A Resource, Reshoring & Upskilling

Submitted by DeDora Capital on September 9th, 2016

by Will Becker, AWMA/AIF

Planning Perspective

What if you were out on a hike with a friend, and he/she asks, “Are you on track to have $1mm in your 401(k) by the time you are in your mid-fifties?” Further, “if you are on track, how did you get there? If you aren’t, what choices had you made that had prevented you from reaching that number?” Set aside the dollar amount for a moment, and ponder the larger question: how can to have a casual, easy flowing conversation about key financial decisions that helped or hindered your financial success – and how can to be a resource for someone seeking to benefit from your experience.

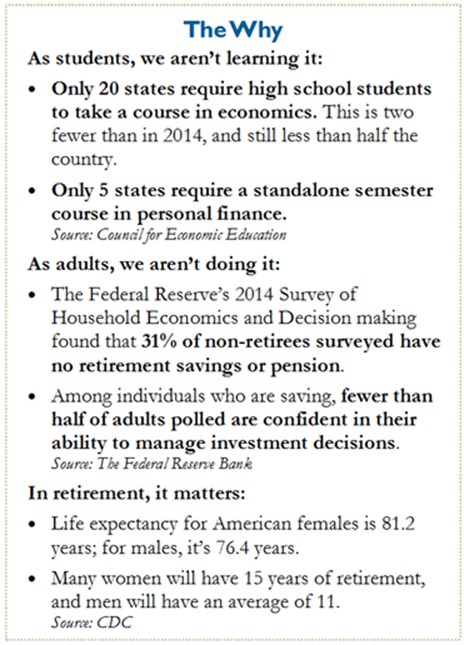

That experience led to an insightful article on how to talk about Money in a way that isn’t about guilt, shame, boasting, or numbers. It’s actually more about feeling less alone on a subject that can be hard to talk about. And here’s why this is important: according to the Federal Reserve’s 2014 Survey, “31% of non-retirees surveyed have no retirement savings or pension.” Plus, “fewer than half of adults polled are confident in their ability to manage investment decisions.” No! No! No! This is terrible! First of all, from the bottom of my heart, I hope that you feel confident in your ability to manage investment decisions. You certainly should feel confident about that because not only do you have the meetings and conversations with the DeDora team to draw on, but you know that if something else comes up you can always run it by us; and that’s on top of what you already know. That is what we are here for! Second, I encourage you to read the article for the simple reason that you can be a resource for people trying to sort out financial decisions, and you have the DeDora team as your resource if something comes up that you aren’t sure how to answer. If you have had a financial conversation with someone recently, please let us know how it went!

Investment Perspective

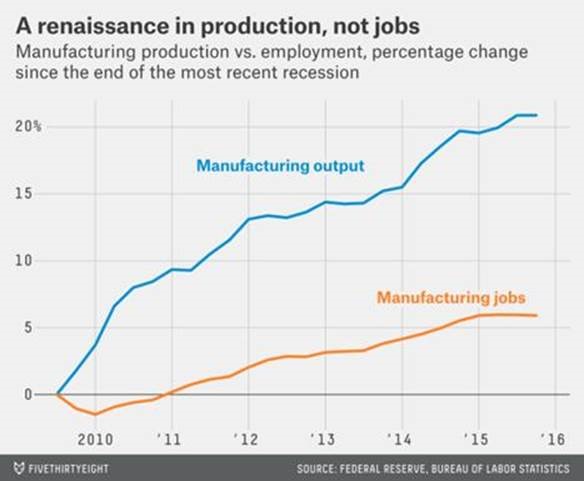

This week’s theme is Manufacturing, Reshoring, and Upskilling. Manufacturing output in the U.S. has been doing really well during the economic recovery (see blue line in chart below), but Manufacturing Jobs are lagging (see orange line in chart below). Why? Turns out that manufacturing may be coming back, but it’s coming back differently.

“Reshoring” is when a company brings manufacturing & services back to the U.S. from abroad. In recent years a number of companies have returned manufacturing to the U.S., often citing rising wages in China, faster production cycle, or quality concerns. This is great for those building & equipping the factories, and you would think that it would put a bunch of manufacturing folks back to work… except it’s not quite turning out that way (again, check out the orange line on the chart). It turns out that these new factories are “heavily automated, employing a small fraction of the workers they would have a generation ago” according to an aptly titled article “Manufacturing Jobs are Never Coming Back.” So there are fewer jobs in each factory, and the types of jobs that are created are different. Assembly is increasingly being done by robots, while the human jobs are in the supervising of the robots. This is a form of “Upskilling”, where the type of job needed becomes higher skilled over time. So there is not much demand for assembly line jobs, but lots of demand for engineers. One factory described the difficulty finding “technicians with the electrical and mechanical skills needed to maintain the complex machines. One electrical maintenance role went unfilled for over a year as he searched for someone with an associate’s or bachelor’s diploma, ideally in manufacturing engineering.” He went on to say, “Back 15 years or so, the machines weren’t as sophisticated as they are now.”

To put it another way: Assembly line jobs came back… but many of those jobs are filled by Robots. Turns out we need more technicians and engineers to set up the factories and run the robots. Chris Rupkey from MUFG Union Bank in New York even went so far as to call this “one of the biggest mismatches between skills and lack of qualified help available in the nation's history."

I’ve spent a lot of time running job training programs or mentoring folks seeking a career path, and I have found that people often think “getting an education” means “getting a degree that is not connected to anything you will ever be paid to do.” The manufacturing data reminds me that getting an education certainly includes degrees and certifications in subjects that are highly practical in their job prospects!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.