Back to School, Election, and Expectations vs Surprises

Submitted by DeDora Capital on July 28th, 2016

by Will Becker, AWMA/AIF

Planning Perspective

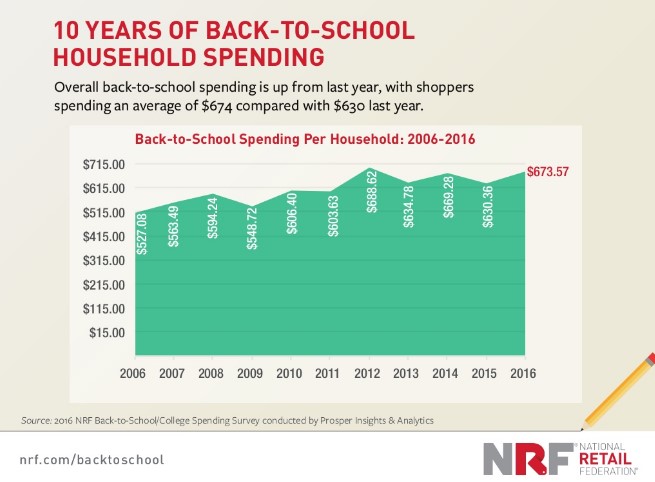

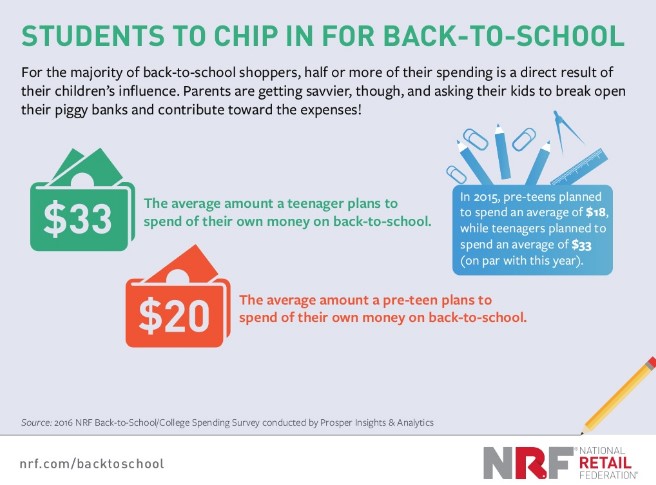

It’s Back to School time! For those of us with school age kids (my daughter is headed into Kindergarten next month… where did the time go?), this is the wrap-up for summer vacation and time for Back-to-School shopping. It turns out that shoppers are spending an average of $674 this year, up slightly from last year. Teenagers are pitching in about $33 of that, interestingly.

Investment Perspective

Some comments on the Election, and then Expectations vs Results.

Ok, so Election Season is upon us. We now have official major party candidates with vice presidential running mates and the Democratic and Republican Conventions are wrapped up. The newspapers are full of all sorts of arguments and counter arguments. As folks know, our team is staunchly neutral in our professional lives when it comes to politics. We have to be. Our professional duty - enshrined in our nation's laws and regulations - is to be a fiduciary to our clients! This means putting your best interest ahead of our own! There’s plenty of advocacy and electioneering organizations - it’s just not what we do. Paul, Forrest, Terri, Janie, and I will say one thing when it comes to this election - VOTE! If the election is getting you down, remember the sage words of Winston Churchill: “Democracy is the worst form of government except all those other forms.”

As investment managers we have to consider everything that could affect investment results… so here are some things on our minds. The answers will evolve as the election unfolds, but our primary focus is on these questions:

- What is currently "priced into the market"?

- What if one of the major candidate’s campaigns implodes?

- Is one of the candidates going to have a better economic impact, and if so, how?

- What is the typical market response to election years?

I want to take a few minutes to address that last point. Going back to 1928, the 4-year Presidential Election cycle sees positive returns of, on average, 7%. In election years where the incumbent is not seeking re-election, such as this year, the S&P 500 has a history of slightly negative returns (-2.8%). That data is courtesy of Stephen Suttmeier from Bank of America Merrill Lynch, and I have to add a really big caveat that there’s not much data to go on. There’s only five times we’ve had such situations in the past 100 years, and one of them was a 4 term Franklin Roosevelt… so the results can be easily skewed by one or two odd years. Nonetheless, it’s one more piece of evidence to suggest modest investment returns this year. Elections bring uncertainty; markets don’t like uncertainty. Elections bring up divisiveness; this stresses everyone out. The economic factors we were already concerned about continue to be relevant – especially earnings, European economies (ahem, Italy), and inflation/deflation.

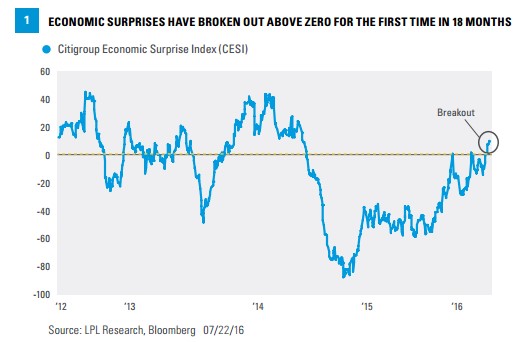

I want to close out with a quick discussion on Expectations vs Results, and introduce an Indicator that we watch. Many years ago I remember seeing a company post really bad earnings, but then their stock price immediately went up. Why on earth would that make sense? This was my introduction to the importance of expectations. It turned out that the company was expected to do terribly… so only earning some money was better than earning virtually no money… and viola… the stock price went up! The Citigroup Economic Surprise Index (CESI) is a nifty indicator using this same basic idea and apply it to 85 different economic factors. The CESI looks at how those factors are doing relative to expectations. “The index rises when economic data exceed economists’ consensus estimates and falls when data come in below estimates,” according to LPL Research.

So what does this indicator say now? “After an 18-month stay in negative territory, the July 8, 2016 reading put the index above zero.”

How important is this? According to LPL Research,

“Over the past 10 years, when the CESI breaks above zero (14 instances), the S&P 500 was higher over the subsequent 6 months 79% of the time with a median gain of 5.2% (the average is lower, dragged down by a 35% drop in 2008). Excluding the Great Recession, stocks rose in 11 of 12 instances with a median gain of 6.3% (and an average of 6.9%) over the subsequent 6 months. We have also observed better performance from the more economically sensitive sectors in these scenarios. Both good signs.”

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.