All Time Highs & Pullback

Submitted by DeDora Capital on June 15th, 2017

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

The past two weeks Tech stocks pulled back, with the Nasdaq stepping back from highs while the S&P 500 and Dow Jones are slightly up. Companies like Apple, Amazon, and Google pulling back can generate catchy headlines and spook folks, but here are a few things to keep in mind.

These same companies are up A LOT this year. Google, Facebook, Amazon, and Apple are all up +20% year-to-date, as this chart from FinViz shows. Light green boxes gained the most - and there is copious green on this chart. Pretty much every sector except basic materials and telecommunications is awash in Green. Rebalancing throughout the year to trim winners can commonly result in modest pullbacks such as the Nasdaq this week.

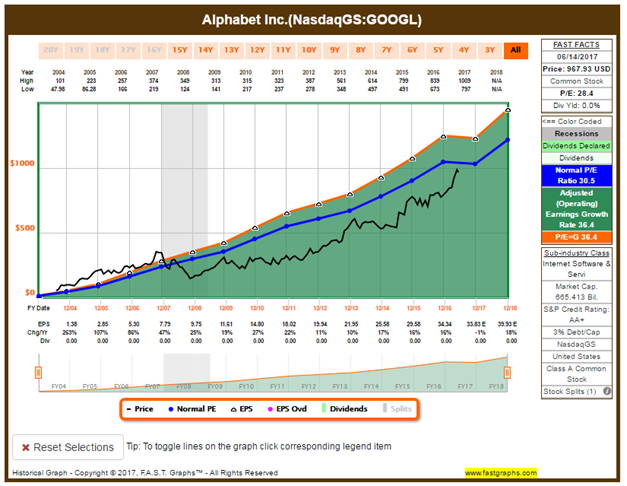

The companies I mentioned are up this year because they are generating enormous amounts of earnings and cash flow. In the interest of space, below is one of the three companies I mentioned - Google's earnings (green area below).

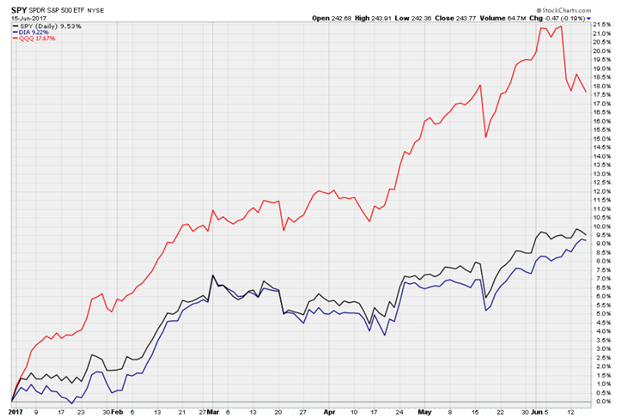

While the Nasdaq got stunned for a few days the Dow Jones and S&P 500 quietly hit record highs. Below is a chart showing the Nasdaq, Dow Jones, and S&P 500 this year-to-date. This is also consistent with large institutional traders taking some profit from tech leaders and invested in under-weight Blue Chip positions.

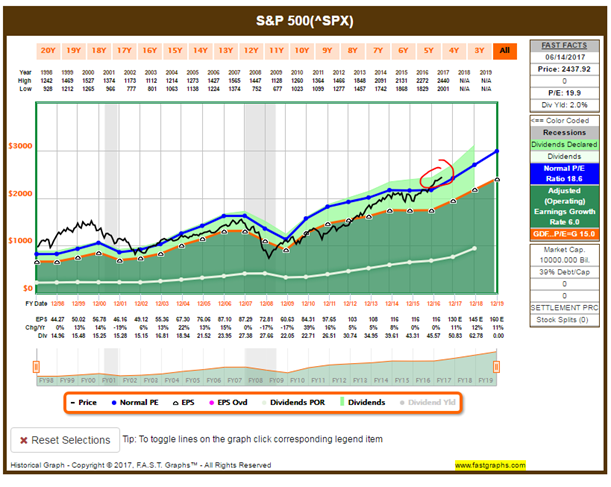

What does this mean for investors now? U.S. Equity Markets are at or near their all time highs because the companies in those markets are profoundly profitable at the moment. It is a good thing that the Nasdaq took a breather and the other Large Cap indexes got their moment in the sun. According to FactSet, we are currently seeing the highest number of positive EPS announcements for the S&P 500 since 2012. That being said, we are keeping a close eye on how earnings look going into the second half of the year... we are concerned that the S&P 500, for example (below), is starting to get towards the upper end of its fair market value based on current earnings.

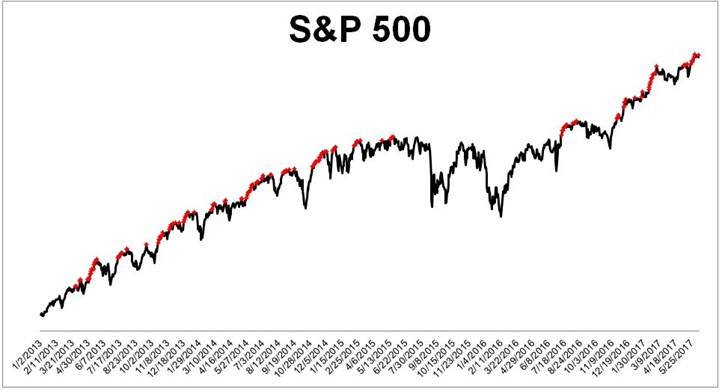

All this talk of "all-time-highs" reminds me of the obvious-but-still-worth-saying point that really good markets hit all time highs all-the-time. Analyst Michael Batnick has a great graphic showing each new "all-time high" since 2013 marked in Red. And in this case there is a lot of good-news-red on the chart below.

Oh, and Happy Father's Day this Sunday!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.