The Active in Custom, Active, and Tax Sensitive

Submitted by DeDora Capital on February 23rd, 2018

by Will Becker, AWMA/AIF

Happy Friday!

A few comments on the flu, then on to the markets.

The Flu

"The entire country is experiencing widespread and intense flu activity, "according to the Washington Post, and this year's flu rivals the 2009-2010 swine flu in terms of people seeking medical care. "1 out of every 13 visits to the doctor last week was for fever, cough and other symptoms of the flu" ... "that level is among the highest in a decade." This article, also in the Washington Post, includes additional information and precautions. Be well, everyone!

Investment Perspective

This year Paul and I want to take a few more opportunities to share behind-the-scenes work that the DeDora team does. Economic Analysis is one of those really nerdy things we do, and in the interest of still having friends we tend to keep it at the office. But this is about YOUR money, so if you would like more of a peak into Economic Analysis, check out the info below. If you want to go into more detail, just let me know. But be forewarned: we really like nerding out on this, so you know, careful what you ask for. :)

There is a common sentiment that markets can't be timed, and this philosophy can be summed up as "Set & Forget." While this isn't our investing philosophy, there are some really sound reasons for folks to feel this way. One reason is that humans are notoriously bad investors.

Dalbar, for example, estimates that "the average equity mutual fund investor underperformed the S&P 500 Index by a margin of 4.7%." This led to the following humbling headline: "Americans are still terrible at investing, annual study once again shows." According to Dalbar, psychological factors are the largest reason for under-performance.

So if people are notoriously bad at investing, what is the alternative? Our investment philosophy is summed up by Custom, Active, and Tax Sensitive. Each client's situation is different, and there may be custom holdings, private equity, socially responsible investing, etc. Those are elements of the Custom part. The Tax Sensitive part I can go into another time, but it affects everything from kinds of investments to kinds of accounts. Today is really about the Active part. As part of Active investing, we use a process to track where we are at in the economy, and do our best to adapt. Then we select investments that fit within the current economic environment (usually a mixture of low cost Passive funds and Active Funds with solid track records, though also a couple Stock investment strategies). Finally, we continue monitoring the investments, economy, and each client's circumstance to determine how we should adapt the investments over time. For example, portfolios are set up to grow with the economy but be low on fixed income duration due to interest rate increases.

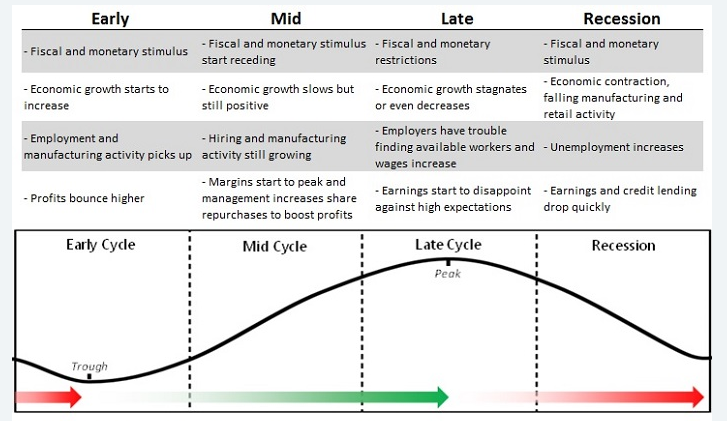

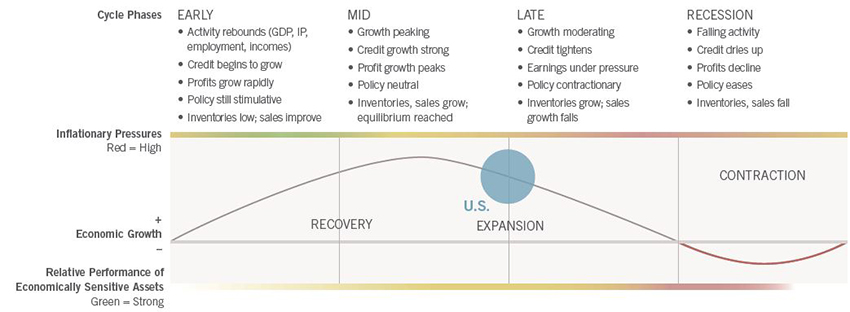

I want to drill down on the economic part of the process. There are characteristics to each phase of the business cycle, shown on two handy charts below. I included both since one includes inflation and the other one has better descriptions for each phase. Chart 1 & Chart 2. Examples of items that should be on the horizon as Late stage of the cycle begins to tip closer towards Peak and then Recession: earnings growth slowing, more earnings disappointments vs expectations, employers having more trouble finding employees, economic growth slowing, inflation growing, and interest rate issues.

So when there is a "correction" (-10%) while the economy is expanding, that's ok. It's the market course correcting on its way up. But when the indicators are flashing red and buzzers are screaming, and THEN the market corrects... that is a problem!

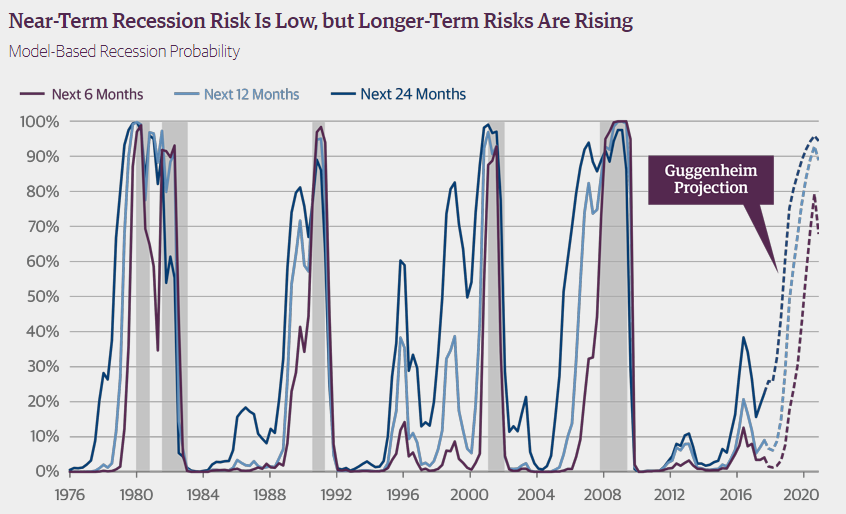

All of this leads to the invariable question: when is the next recession? When will the economic Bear wake? Guggenheim, for example, uses a variety of familiar indicators to project a recession in late 2019 or 2020. THAT COULD ALL CHANGE, which is why we voraciously devour economic information. But it's a starting point. Until then, tick tick tick...

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.