564,000 Idled Acres & Gas Prices

Submitted by DeDora Capital on March 11th, 2016

by Will Becker, AWMA/AIF

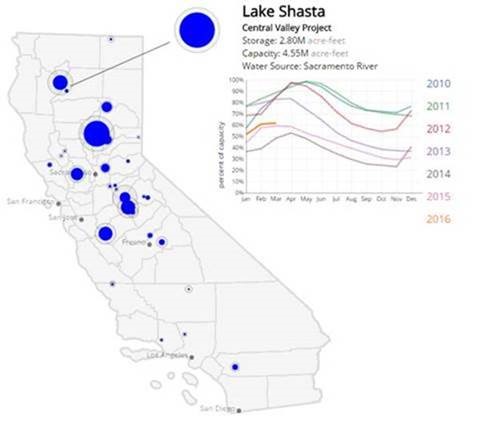

As I am writing this, a pleasantly strong rain just started here in Napa. Snowpack is up to 2012 level, and most of California’s reservoirs are recovering from their drought doldrums. Note I said “recoverING.” Not “recoverED.” The rain is helping, but Rome wasn’t built in a day and a drought isn’t over in a month. Below is an image showing Lake Shasta’s levels since 2010, using this nifty interactive chart. For those in Napa, here is a site to check stream & reservoir levels. These rains are a really big deal. Back in 2015, the University of California estimated that the drought resulted in “564,000 idled acres.” According to their study, this caused farm revenue losses of $1.8 billion, as well as economy-wide revenue losses of $2.7 billion and 18,600 fewer jobs. For reference, the lost farm revenue is equivalent to the annual GDP of Belize and half the acres of Rhode Island going fallow.

Now on to Gas. There are a lot of arcane financial metrics and indicators that we digest on a regular basis. But I often find that financial transactions of daily life can be just as insightful. Gas is a great example. Even though Gas in California is about 80 cents/gallon more expensive than the rest of the country, it is still really, really cheap right now. The last time Gas was this cheap was 2009, and before that it was 2005. This results in significant savings at the pump. “The average household saved $660 in 2015 from lower fuel prices and is predicted to save $300 this year” according to the Energy Information Administration. What are people going to do with that money? The National Retail Federation reports that paying down debt is an overall priority. For example, they report that 49% of consumers plan to save their tax refunds instead of shopping. If that doesn’t seem shocking, then maybe this will help: that is the highest percentage in the history of this survey. For a nation notoriously bad at saving, 49% turns out to be good news. The NRF is also reporting that retail employment had a strong February – following a similarly strong January. This means that “the consumer is confident and continuing to shop”, according to the NRF. i.e. Spending!

This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.