Spaceman & Punctuated Equilibrium

Submitted by DeDora Capital on February 9th, 2018

by Will Becker, AWMA/AIF

Happy Friday!

This week I felt like a kid in elementary school watching the SpaceX Falcon Heavy rocket launch... and hoping with all my might that it wouldn't blow up like the Challenger rocket in 1986. It did fine! With the power of 18 747 jumbo jets, Elon Musk's SpaceX launched the biggest rocket of this millennium into space. Oh, and two of the booster rockets returned to launch pads for re-use. Oh, and Musks's red Tesla Roadster was launched in orbit to Mars. If you haven't seen the footage yet, you can check it out here.

Investment Perspective

On Friday, better-than-expected jobs report & consumer confidence numbers came out. Over the next two trading days the Dow Jones dropped -665 points and then dropped -1,175 points. On Tuesday the Dow Jones Industrial Average rebounded +567 points, on Wednesday a tame -19 points. So what's up with the market gyrations? Isn't consumer confidence good? Aren't rising wages good? From the perspective of workers and household incomes, rising wages are good! But from an investment perspective, there are a couple problems. First, rising wages indicates inflation may be waking up - which is an indicator of the later stages of a growth cycle. Second, rising wages puts pressure on profits. The job market is already getting tight. For example, this year Wal-Mart announced increases to starting pay, year-end bonus, and paid parental leave. These are things a company does to try to keep employees, not boost short term profits. But then interest rates went up as a result of all this, and that added to the market tumult.

Back in 1972, Evolutionary Biologists Stephen Jay Gould and Niles Eldridge coined the "Punctuated Equilibrium" theory. In short, they found that species are generally fairly stable, evolving at a 'leisurely' pace until punctuated by a rapid burst of change. We often see financial markets acting like an ecosystem. I am fond of referring to the global flow of funds as similar to water running down a hill; it is going to move downhill and work around the landscape as it goes. The shift in expectations of inflation and interest rates that we are experiencing at the moment is a modest punctuation. Also, note that 2017 was an odd year in that the S&P 500 went up so consistently

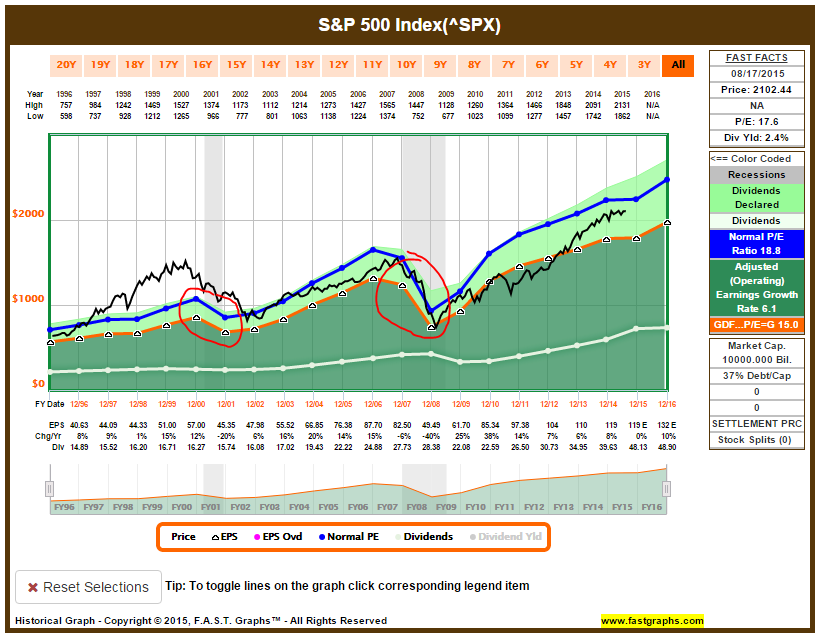

Among the couple dozen particularly useful indicators, Interest rates, inflation, unemployment, and earnings are frequent flyers when it comes to gauging overall market health. At the moment, the first three are pointing toward the latter stages of a the growth phase of the business cycle. With Earnings, the S&P 500 is a bit pricey, but earnings continue to increase (Red circle). Compare that to the last two recessions (in blue circles) where prices were elevated compared to earnings AND then earnings fell.

If you would like to go into more detail on the markets, your accounts, or financial plan, then please let me know!

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.