1929 vs Today

Submitted by DeDora Capital on October 15th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Investment Perspective

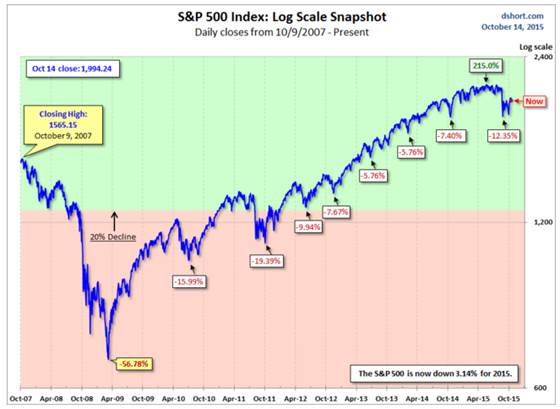

A quick note on the markets, then on to a more historical perspective. Last week was the best week in the U.S. markets this year. Some of the enthusiasm comes from the mediocre-news-is-good-news cycle that we have been in for several years. Basically, here's how it works: "Hooray, the economy is still messed up - that means interest rates will stay low!" As I wrote recently, the employment picture calls for an interest rate hike; but inflation has not shown up to the party yet. Until it does, interest rates are unlikely to move very far/fast. A chart dating to Wednesday of this week shows that the S&P 500 recovering significantly from the dip of the past two months.

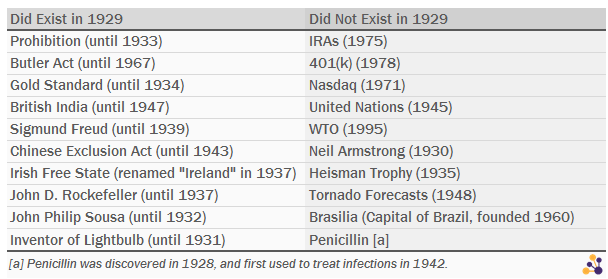

The historical perspective is on the familiar refrain "This time is different." Our industry likes to use this phrase, and it is typically followed by a chorus of historically minded folks pointing out the myriad of ways that history tends to repeat itself. The 2011 book "This Time is Different: Eight Centuries of Financial Folly" sums up a historical view pretty well. The Great Crash of 1929 is the benchmark of investing calamity, and Michael Johnston’s recent comparison of 1929 vs today illustrates the folly of taking this too far. Some pretty major things have changed since 1929.

Highlights paraphrased from Mr. Johnston’s article include:

- In 1929, Life expectancy for men was 58 years old; today it is 76.

- Influenza & Pneumonia were the 2nd leading cause of death.

- It took 33 hours to fly to Europe (and asking fishermen for directions); today there are 150 daily flights that take about 8 hours to get there.

- There were no IRA/401k accounts.

- Alcohol was illegal, thanks to Prohibition.

- We subsequently added territory the size of Germany & Norway combined through the addition of Alaska & Hawaii.

A particularly powerful comparison from the article:

History can repeat itself... but typically not exactly the same way. The financial news media can get caught up on comparisons to extreme events, so let's also keep in mind what has happened since the investing calamity that was 1929. For example, we now have Penicillin, Ibuprofin, and Social Security.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.