17,000 Evacuated & Dot Plot

Submitted by DeDora Capital on September 17th, 2015

by Will Becker, AWMA/AIF

Happy Friday!

Team Update

Last weekend, the Valley Fire fire swept through Lake County and this week it extended into Napa and Sonoma Counties. As of Thursday this week, CalFire reports that the Valley Fire has burned 73,700 acres, and is still only 35% contained. 585 homes are destroyed, and 17,000 evacuated. Governor Brown declared a state of emergency. We met with clients while they were evacuated, and we have been in contact with several more affected clients. Many of the evacuees are currently at the Calistoga Fairgrounds, and we are proud of the strong local volunteer support. I know many of our clients were affected by fires in the past year in the Yreka/Shasta area, and it seems like catastrophic forest fires have been particularly damaging the past two years. At least to the folks we know. Please be safe, everyone. Please be safe.

Disasters reminds me to mention emergency plans. If the DeDora team is displaced, our work goes on relatively uninterrupted. Even during the Napa Earthquake, we were up and running rather quickly from remote offices. Since converting to our own Firm, our emergency preparedness is even stronger. We have multiple redundant systems, and our technology systems are almost entirely web-based. We can work from anywhere there is a cell phone & internet connection, and we have multiple encrypted mobile hotspots if needed. Just want you to know that we've put these measures in place to have continuity in case an emergency strikes the downtown Napa area again.

Investment Perspective

This week's economic news focused on the much anticipated September meeting of the Federal Reserve. This event is like the NBA Draft for investors. Like it or not, the Federal Reserve's mandate is to "promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates."

Unemployment and inflation are referred to as the "Dual Mandate" of the Federal Reserve. So let's take a quick look at how we are doing on those. Way back in 2012, the Federal Reserve tried to calm markets by saying that interest rates would stay low until the unemployment rate reached what was then a shockingly low number: 6.5%. Today, the Unemployment rate is 5.1%. So we are good on that one. However, inflation continues to fall well below the 2% target - herein lies the problem. International economic drama has a way of keeping a lid on inflation. So while our economy continues to expand and employment continues to improve, the Federal Reserve is unenthusiastic about raising interest rates until stuff costs more. Plus the International Monetary Fund asked, pretty please, do not raise interest rates.

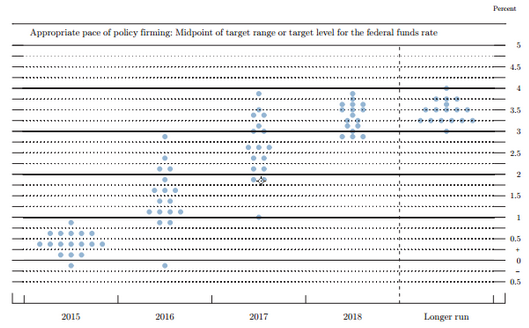

But you know I wouldn't talk about this without a chart, so below is what us market nerds call the Federal Reserve's "Dot Plot." Each dot represents a Federal Reserve member's judgement of the appropriate Federal Funds rate. Does this remind anyone else of the old game Battleship?

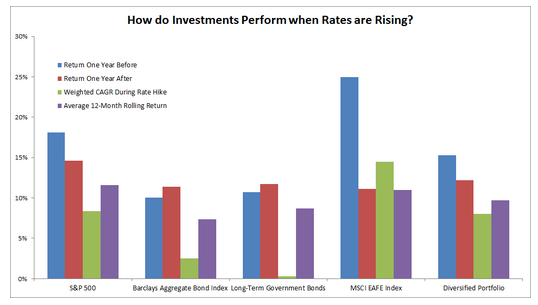

Why all the hullabaloo over rising interest rates? The reason is that a rising interest rate environment can be really dangerous for some investments, such as long term bonds and interest rate sensitive investments such as utilities. The Financial airwaves are full of angst over rising interest rates. I say all of that as background to the real question: how can a portfolio survive rising interest rates? The answer is that U.S. stocks are surprisingly resilient during rising interest rates, diversification makes a key difference, bonds do not suffer uniformly, and we are low on duration anyway. In short, we are already positioned for it.

Columnist Josh Brown echoed many of our thoughts on this topic in an article back in May, and the chart below illustrates his point that a globally diversified portfolio provides insulation from a rising interest rate environment. We agree.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Disclosure: This commentary on this website reflects the personal opinions, viewpoints and analyses of the DeDora Capital, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by DeDora Capital, Inc. or performance returns of any DeDora Capital, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. DeDora Capital, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.